Lesson series

Shipping Risk Management & Derivatives – An Applied Approach

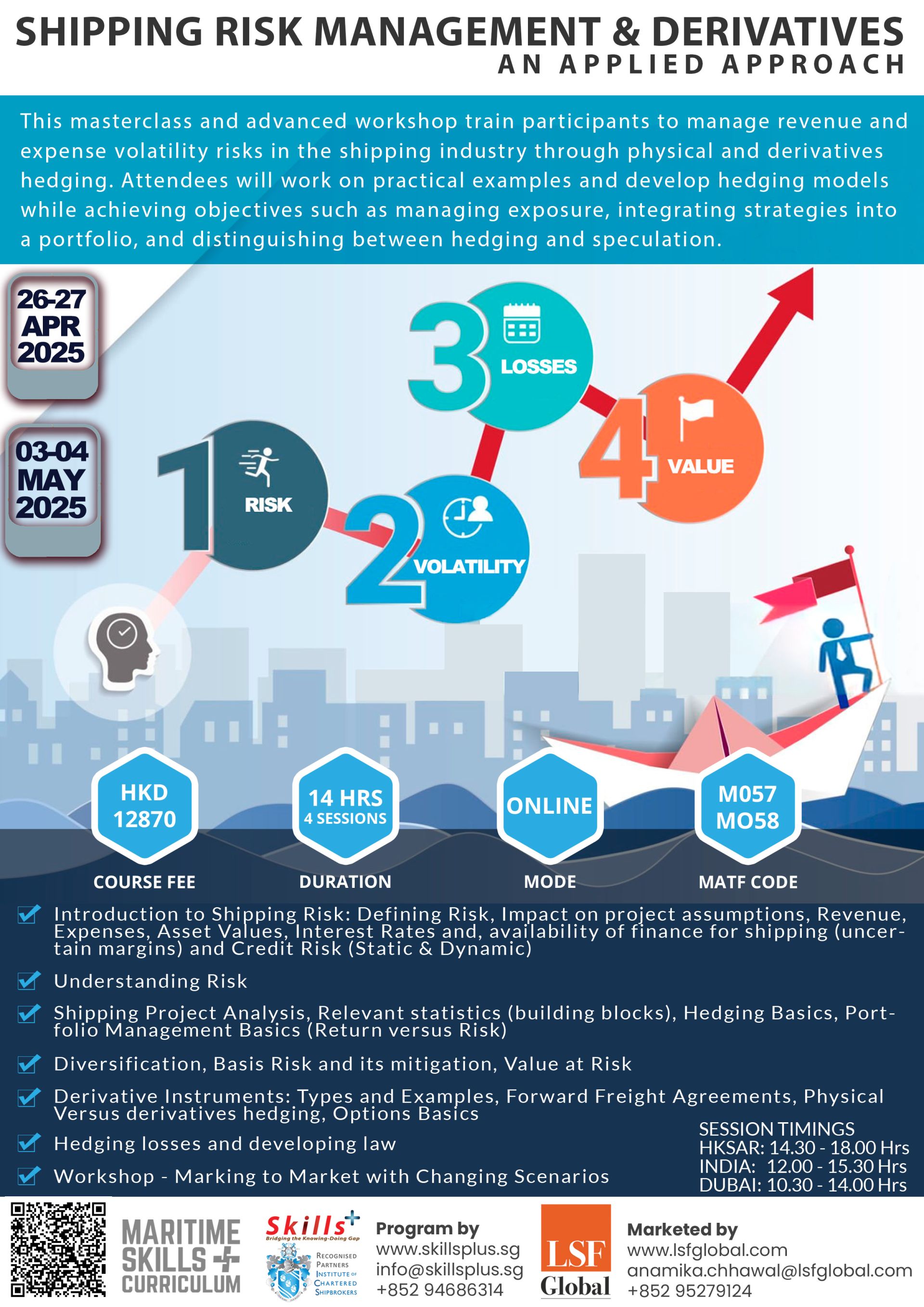

This masterclass and advanced workshop train participants to manage revenue and expense volatility risks in the shipping industry through physical and derivatives hedging. Attendees will work on practical examples and develop hedging models while achieving objectives such as managing exposure, integrating strategies into a portfolio, and distinguishing between hedging and speculation.

Mode

Online Program (Zoom)

Language

English

Total Duration

14 hrs

Total Sessions

4 (3.5hrs each)

Price

USD$

1670

Price

HKD

12870

Advance your career

Program Overview

Product Description

Program Overview

Professionals: Chartering, Risk Managers, Trade-book Managers

Program Format:

This masterclass and advanced workshop train participants to manage revenue and expense volatility risks in the shipping industry through physical and derivatives hedging. Attendees will work on practical examples and develop hedging models while achieving objectives such as managing exposure, integrating strategies into a portfolio, and distinguishing between hedging and speculation.

Topics

Topics

- Introduction to Shipping Risk

- (Defining Risk, its impact on project assumptions, Revenue, Expenses, Asset Values, Interest Rates and availability of finance for shipping (uncertain margins) and Credit Risk (Static & Dynamic)

- Understanding Risk

- Shipping Project Analysis, Relevant statistics (building blocks), Hedging Basics, Portfolio Management Basics (Return versus Risk)

- Diversification, Basis Risk and its mitigation, Value at Risk

- Derivative Instruments

- Types and Examples, Forward Freight Agreements, Physical Versus derivatives hedging, Options Basics, Mark to Market

- Hedging losses and developing law

- Workshop - Marking to Market and Changing Scenarios

Professionals: Chartering, Risk Managers, Trade-book Managers

MAFT Code: MC057 & MC058

Program Format:

Mode – Online Program (Zoom)

Language: English

Total Duration: 14hrs

Total Sessions: 4 (3.5hrs each session)

Session Date: 26 Apr / 27 Apr / 3 May / 4 May 2025

Session Timing: Hong Kong 14.30-18.00 hrs | India 12.00-15.30 hrs | Dubai 10.30-14.00hrs

Course Fee: US$1670 | HK$ 12870 (Bank charges both ends to be on remitter's account)

MATF Code: MC057 & MC058

Total Duration: 14hrs

Total Sessions: 4 (3.5hrs each session)

Session Date: 26 Apr / 27 Apr / 3 May / 4 May 2025

Session Timing: Hong Kong 14.30-18.00 hrs | India 12.00-15.30 hrs | Dubai 10.30-14.00hrs

Course Fee: US$1670 | HK$ 12870 (Bank charges both ends to be on remitter's account)

MATF Code: MC057 & MC058

Payment Option

1) Bank Transfer Payment

SkillsPlus Ltd - A/C No. 239762149883; Hang Seng Bank; Swift Code: HASEHKHH

2) Credit Card

Click here

(Please email the remittance slip to info@skillsplus.sg and anamika.chhawal@lsfglobal.com)

(Please email the remittance slip to info@skillsplus.sg and anamika.chhawal@lsfglobal.com)

Avail Discount

• This is a MATF Program (eligible participants may apply for 80% refund from the Government of Hong Kong, SAR).

• Early Bird Discount 10% if registered by 15th Apr 2025

• Group Discount: 10% if three (3) or more from the same firm (max discount 25% including early bird).

• Additional discount of 5% for ICS / NI / WISTA / HKMLA members.

Lead Trainer Profile: Mr. Jagmeet Makkar

Independent Arbitrator & Mediator; Former IME(I) Chair - Indian Maritime University; Sea Ambassador ISWAN; Chairman - Institute of Chartered Shipbrokers (HK Branch); Ambassador HK - Baltic Expert Witness Association

https://www.linkedin.com/in/skillsplus-jagmeet-makkar

For more information on Maritime Skills+ Curriculum

For more information on Maritime Skills+ Curriculum

LSF Global +852 95279124 | anamika.chhawal@lsfglobal.com

SkillsPlus +852 94686314 | info@skillsplus.sg

SkillsPlus +852 94686314 | info@skillsplus.sg

Lead Trainers Profile:

Mr. Jagmeet Makkar

Independent Arbitrator & Mediator; Former IME(I) Chair - Indian Maritime University; Sea Ambassador ISWAN; Chairman - Institute of Chartered Shipbrokers (HK Branch); Ambassador HK - Baltic Expert Witness Association